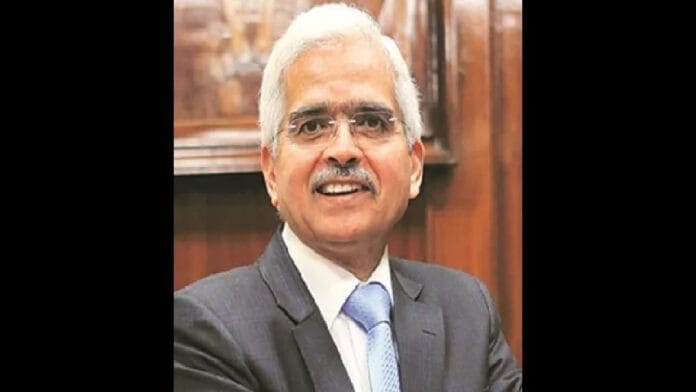

Shaktikanta Das bids goodbye to the office of Reserve Bank of India (RBI) Governor after six years of memorable stint on Tuesday. He shares his gratitude and reflections in a series of posts on microblogging site X.

“Will demit office as Governor RBI later today. Thank you everyone for your support and good wishes. Immensely grateful to the Hon’ble @narendramodi for giving me this opportunity to serve the country as Governor RBI and his guidance and encouragement. Benefited a lot from his ideas and thoughts,” he wrote

In his posts on X, Das thanked Finance Minister Nirmala Sitharaman for fostering fiscal and monetary coordination during his tenure. He also expressed gratitude to his RBI colleagues for their efforts in steering through global shocks and economic challenges.

Appointed as the RBI Governor on December 12, 2018, after the abrupt exit of Urjit Patel, his tenure is expiring today. Revenue Secretary Sanjay Malhotra is all set to replace him as the 26th Governor.

A 1980 batch IAS officer, Das leaves behind an illustrious career spanning over 38 years, serving in different wings of governance, and lastly as the country’s key economic policy maker. During his long tenure in the Ministry of Finance, he was directly associated with the preparation of as many as eight Union Budgets.

One of his keys contributions to the Indian economy, as the RBI Governor, has been his efforts to ensure that economic growth remains over 7 per cent in the last 4 years of his six-year term as the RBI Governor.

A post graduate from Delhi’s prestigious St Stephen’s college, Das took over as the RBI Governor at a time when market was shaken by the sudden resignation of Patel amid a tussle between RBI and the government over the issue of surplus transfer.

He deftly managed to assuage the concerns of the market while smartly sorting out issues related to surplus transfer to the government.

Just a year after he took over as the RBI governor, Covid hit the world, slowing down the economy due to lockdown. But Das succeeded in managing the disruptions caused by the lockdown by cutting the policy repo rate to a historic low of 4 percent.

Das headed the Monetary Policy Committee (MPC) and raised interest rates to avoid overheating the economy and keep inflation under check after the economy showed signs of revival.

His tenure will be remembered for being in complete sync with the wishes of the Narendra Modi government after the tumultuous successive stints of Raghuram Rajan and Urjit Patel, which saw constant conflicts between the RBI and the Ministry of Finance.

It was natural, as even before joining the RBI, Das spearheaded Prime Minister Narendra Modi’s 2016 demonetisation drive while the then RBI Governor, Urjit Patel, took a backseat through the whole process.