The All-India body of the Indian Revenue Service Association (Income Tax Cadre) has elected its new office bearers, marking a generational transition in the representative body of Group ‘A’ Income Tax officers.

Senior IRS officer Banita Devi Naorem (IRS-IT:1998) has been elected President of the Association, while Deepshikha Sharma (IRS-IT:2000) has taken charge as General Secretary. The post of Joint General Secretary will be held by Ankur Jain (IRS-IT:2020), one of the youngest officers to assume a key role in the central association.

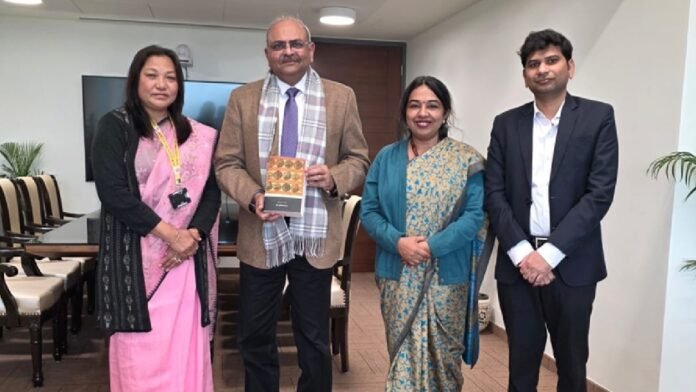

Soon after assuming office, the newly elected team called on Ravi Agrawal (IRS-IT:1988), Chairman, Central Board of Direct Taxes (CBDT), along with Sanjay Bahadur (IRS-IT:1989), Member (Income Tax), CBDT, and Mona Singh (IRS-IT:1990), Member (Administration & Judicial), CBDT. During the interaction, the Association presented a copy of Kautilya’s Arthashastra—a classical treatise on statecraft, governance and public finance—symbolically underlining the civil service’s role in ethical administration and fiscal responsibility.

The Indian Revenue Service Association (Income Tax Cadre) functions as the apex representative body of Group ‘A’ Income Tax officers across the country. Over the years, it has evolved into an important institutional platform for articulating service-related concerns, professional issues and policy feedback to the government and the CBDT.

Beyond advocacy, the Association plays an active role in officer welfare by raising issues related to service conditions, career progression, cadre management and coordination between field formations and the Board. It also facilitates structured interaction between senior and junior officers, helping address administrative, technological and enforcement-related challenges faced by the service.

The Association regularly engages with the government on matters affecting tax administration, including manpower deployment, infrastructure requirements and officer safety, especially during sensitive enforcement assignments. It also promotes professional interaction and mutual support within the service through knowledge-sharing initiatives and assistance to officers and their families when required. With a blend of senior experience and younger representation, the newly elected leadership is expected to focus on capacity building, work-life balance and constructive engagement with the tax administration amid ongoing digital and data-driven reforms in the Income Tax Department.