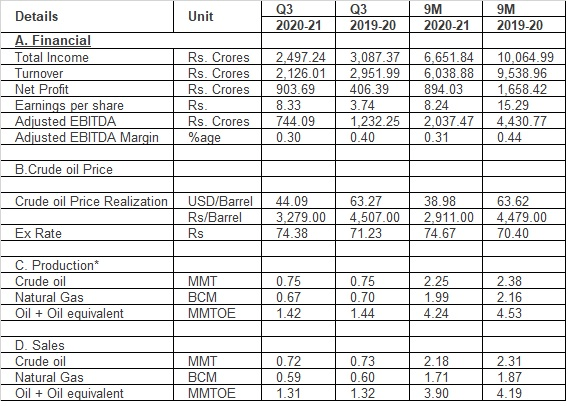

Oil India Limited (OIL), India’s second largest National Exploration & Production Company, in its 519thBoard Meeting held on 11thFebruary, 2021 approved the Q3 and 9 M FY 2020-21 results. Details of Q3 and 9M FY 2020-21 results are as follows:

*includes OIL’s production in joint ventures.

Highlights:

OIL reported 122.37% increase in PAT for Q3 of 2020-21 to Rs. 903.69crore against PAT of Rs. 406.39crore during Q3 2019-20. The PAT for 9M 2020-21 is Rs. 894.03 crore as compared to Rs.1658.42 crore during 9M 2019-20.

The financial performance during 9M 2020-21 was adversely affected due following reasons:

- Reduction in average crude oil price for the 9M 2020-21 to USD 38.98/bblfrom USD $ 63.62/bbl for 9M 2019-20. The decrease in price has led to decease in turnover by Rs.2,838 crore and profitability by Rs.1416 crore during 9M 2020-21.

- Reduction in averagenatural gas price for the 9M 2020-21 to USD 2.19/mmbtufrom USD 3.54/mmbtu for 9M 2019-20. The decrease in price has led to decease in turnover by Rs.625 crore and profitability by Rs.425 crore during 9M 2020-21.

- Exceptional expenditure due to blowout in Baghjan Well.

- The adjusted EBIDTA for 9M 2020-21 is Rs.2,037.47 Crore as against Rs.4,430.77 crore during 9M 2020-21. EBIDTA margin reduced to 30.63% as against 44.02% in 9M 2019-20.

- Crude oil production for Q3 2020-21 has remained flat at 0.748 MMT as compared to 0.747 MMT during Q3 2019-20. Natural gas production for Q3 2020-21 has marginally reduced to 673 MMSCM as compared to 697 MSCM during Q3 2019-20

- Crude oil and Natural gas production during 9M FY 2020-21 was 2.247 MMT and 1993 MMSCM respectively as compared to 2.376 MMT and 2156 MSCM during the corresponding period in the previous year. OIL has declared interim dividend of Rs. 3.50 per share for the FY 2020-21.